Nobel Prize-winning economist Harry Markowitz once famously claimed that “portfolio diversification is the only free lunch in investing”.

As one of the pioneers of Modern Portfolio Theory – the mathematical framework behind diversification – it’s no surprise that Markowitz championed its benefits. However, his work went beyond just highlighting diversification as a good practice, as it provided a scientific foundation for an investing theory that is still used today.

Portfolio diversification involves spreading your investments across different asset classes, regions, and sectors. By doing this, you minimise your dependence on any single market, which can help to reduce the impact of downturns on your portfolio.

But diversification isn’t just about managing risk. It also opens you up to opportunities across different markets and regions, allowing you to capitalise on potential gains that you might otherwise overlook.

The “free lunch” refers to the double benefit of being both better protected against risk and better positioned to capture broader returns. Diversification can also help your portfolio keep pace with inflation and prevent you from making reactive investment decisions driven by short-term volatility.

Read on to explore some of the evidence that demonstrates the benefits of portfolio diversification and why it really is the only free lunch in investing.

Diversifying your investments across global markets helps you avoid portfolio concentration and “home bias”

“Home bias” refers to the tendency of investors to favour domestic markets they are familiar with. While you may find more comfort in this, it can often lead to a concentrated portfolio and increase your exposure to the volatility of a single region.

Spreading your investments across global markets is an effective way to improve your portfolio’s diversification and reduce your susceptibility to home bias. This strategy helps protect your holdings from regional downturns while also allowing you to benefit from growth in other parts of the world.

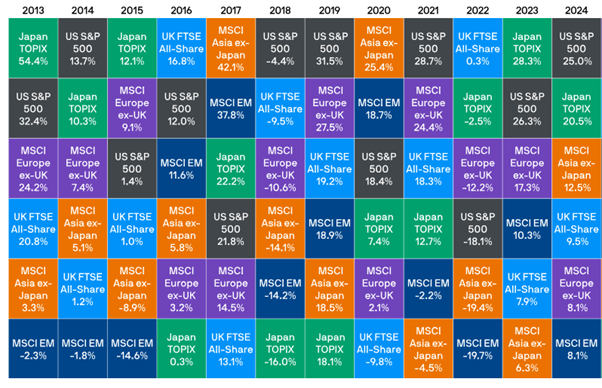

The chart below illustrates the ranked performance of major global indices between 2013 and 2024.

Source: JP Morgan

As the data shows, past performance is rarely a reliable indicator of future results, and it is nearly impossible to predict which indices will perform well based on the previous year’s rankings.

For example, in 2020, the first year of the pandemic, the MSCI Asia ex-Japan index soared by 25.4%, while the UK FTSE All-Share declined by 9.8%. The following year, the FTSE All-Share posted 18.3% gains, while the MSCI Asia fell by 4.5%.

If your investments were over concentrated in either market during those years, your portfolio would have fluctuated significantly. Depending on your temperament, this could subsequently cause you to exit the market to limit your losses, which would mean missing out on the future rebound.

This volatility highlights the risks of concentrating investments in a single region. Such an approach leaves your portfolio vulnerable to market downturns in one area.

Diversifying across global markets can help mitigate these risks, as it offers greater stability and balance. It may also help deter you from making reactive decisions based on short-term fluctuations rather than long-term trends.

However, it’s important to remember that the value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Diversifying across asset classes can strengthen your portfolio and protect your wealth against inflation

Diversifying your investments across asset classes can also offer greater stability and long-term growth potential, and it can even serve as a protection against inflation.

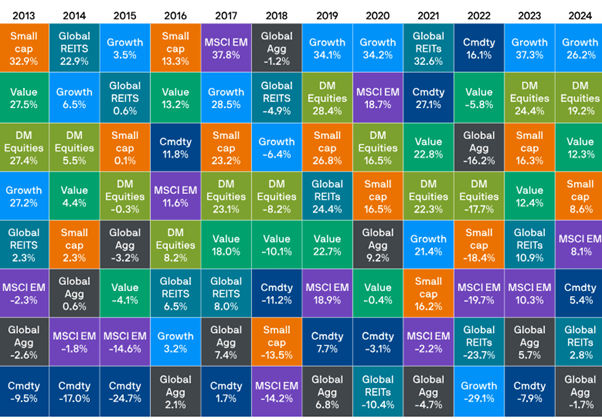

The chart below ranks different asset classes by annual returns, also between the years 2013 and 2024.

Source: JP Morgan

As you can see, just like regional markets, asset class performance is difficult to predict and can shift dramatically from year to year.

For example, in 2022, commodities led the pack with a 16.1% gain, while growth assets suffered the biggest losses at -29.1%. The next year, they switched places – growth assets surged by 37.3%, while commodities dropped to the bottom with a -7.9% return.

Again, diversification can help protect your holdings from such fluctuations, offering a steadier, more stable path to growth.

Moreover, diversifying across asset classes can help your wealth to keep pace with inflation, as some assets tend to perform better than others during periods of high inflation.

For instance, property values often outpace inflation. So, diversifying your portfolio by investing in property could help to grow your wealth and ensure your finances remain stable when inflation is high.

The recent arrival of DeepSeek speaks to the importance of diversification, particularly across sectors

Beyond asset classes and regions, sector diversification is equally important.

Take the US tech sector, which has been one of the strongest performers in recent years. In January, the emergence of China’s AI model DeepSeek caused a market stir, wiping nearly $600 billion from Nvidia’s value in a single day.

While the market has since stabilised, investors overexposed to US tech would have likely felt the impact more severely than those with a diversified portfolio, and they remain vulnerable to future fluctuations.

Markets can be unpredictable, and over-reliance on any one area leaves you open to downturns. By diversifying across multiple sectors, asset classes, and regions, you can reduce risk, limit volatility, and position yourself to capture growth opportunities across different markets.

A financial planner can help you diversify your portfolio to protect your investments and enhance your growth potential

A financial planner can help you build a well-balanced portfolio aligned with your risk tolerance, time horizon, and long-term goals.

By creating a strategy that prioritises diversification, they can ensure your investments are positioned to weather market fluctuations while also capturing growth opportunities.

With a diversified approach, you can stay on course toward your financial goals with greater confidence, stability, and peace of mind.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Risk warnings

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Approved by Best Practice IFA Group Ltd on 03/03/2025