If you have cash held in savings accounts, you’ve probably been buoyed by the fact that the base rate of interest has recently been considerably higher than inflation.

In the last few years, the UK experienced some of the highest inflation in decades, reaching 11.1% in October 2022. The Bank of England (BoE) incrementally raised the base rate of interest to 5.25% in response, which has helped to bring inflation down.

The BoE’s decision to cut the base rate from 5.25% to 5% in August, marked the first cut since March 2020, yet many interest rates offered by banks and building societies are currently higher than inflation.

Combined with the security these accounts provide, this could make holding a larger portion of your wealth in cash an appealing option.

Yet, while there are benefits to cash accounts and they may be particularly advantageous in certain circumstances, cash savings are unlikely to keep pace with inflation over longer time horizons.

Read on to discover why keeping your cash in savings accounts could hamper your long-term returns.

Inflation can eat into your cash savings

Unless the interest on your cash account is consistently higher than inflation, your savings will lose their real value over time.

For example, let’s say that last year you saved £10,000 in a cash account that offered 1% returns on your money and that inflation averaged 2% over the year.

By the end of the year, your cash would have returned £100 and be worth £10,100. While this may initially sound good, due to the effects of inflation, the cash would need to be worth £10,200 to maintain the same purchasing power it had the year before. Over many years you can see how your cash would lose its real-terms value.

Of course, if the base rate of interest was consistently above inflation as it is now, then returns on your savings would likely be enough to ensure they maintained their purchasing power. However, this is not the norm.

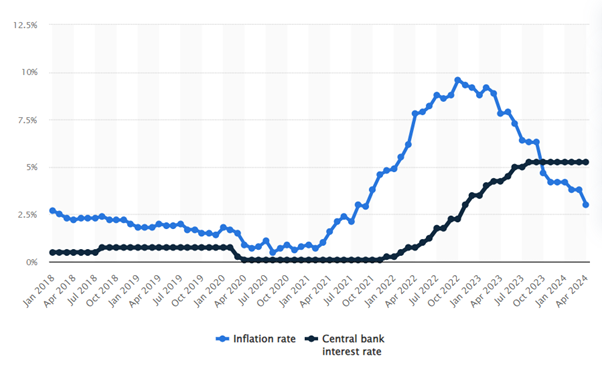

The graph below shows the base rate in comparison to inflation from January 2018 to April 2024.

Source: Statista

As you can see, before October 2023, any cash you held in savings accounts would likely have lost its value in real terms over that period.

While the current situation is advantageous if you’re a saver, it is unlikely to last too much longer. With inflation back down to more manageable levels, the BoE has already reduced the base rate by 0.25% and may continue to lower it further, though they are likely to proceed with caution.

Investing often gives you a better chance of beating inflation over longer time horizons

Cash savings can be a good place to keep an emergency fund or any other money you may need to be readily accessible in the short term. It’s also a useful way to save for shorter-term goals, or if you’re in the run-up to retirement and need access to liquid funds.

However, over longer time horizons, investing has typically given you a better chance of beating inflation.

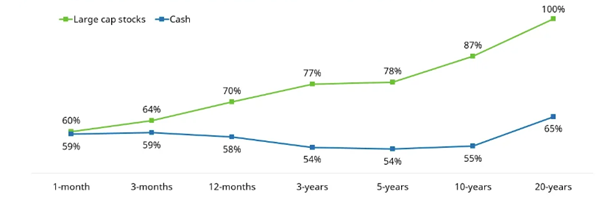

The chart below shows the percentage of different periods where US stocks and cash have beaten inflation between 1923 and 2023.

Source: Schroders

As you can see, if you invested for a single month, the chances of your cash or stocks beating inflation are roughly the same, at 59% and 60% respectively.

However, as time goes on, the chance of cash outpacing inflation decreases over the course of a decade, though it improves slightly over 20 years to a 65% chance.

The chances of stocks beating inflation, on the other hand, continually rises, reaching 100% after 20 years.

So, while holding some cash savings can be beneficial, investing in shares provides your wealth with a greater opportunity to grow and outpace inflation over time.

Savings accounts offer security, but there are also strategies for protecting your investments

One of the main attractions of savings accounts is that they offer a secure place to hold your cash, and it can be reassuring to know exactly where your money is and that it is guaranteed to be safe (up to the Financial Services Compensation Scheme limit).

Although investing in the market always comes with a degree of risk, there are certain strategies you can adopt to help ensure you build a balanced portfolio.

For instance, diversification is among the most effective strategies for safeguarding your wealth.

By spreading your investments across various asset classes, sectors, and geographic regions, you reduce the impact of a downturn in any single area, as the risk is distributed across a diverse set of holdings that are unlikely to decline all at once. Cash may form one part of this asset mix.

Additionally, diversification enhances your potential to capture opportunities for returns in different markets.

It can also be a good idea to remain patient and resilient amid market downturns.

Research by Schroders reveals that liquidating your investments for cash during historical dips would have cost you in the long run.

Investors who chose to exit the market in 1929 at the start of the Great Depression and retreat to cash would have waited 34 years until 1963 to break even. Conversely, those who kept their investments would have broken even in 1945, 18 years earlier.

Likewise, investors who liquidated during the 2008 financial crisis would still not have broken even today. Those who remained in the market would have recovered around 2013.

In both instances, the discrepancy is largely because interest returns on cash tend to be lower than returns on investment.

While cash savings provide a certain level of security, the market has historically generated stronger returns. By diversifying your portfolio and maintaining a focus on long-term goals, you can enhance the security of your investments while also positioning yourself for greater growth.

Get in touch

If you’re looking to grow your wealth and give your cash a stronger chance against inflation, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Risk warnings

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.