Among his many musings regarding the universe, theoretical physics, and the philosophical nature of material reality, Albert Einstein also once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it”.

While it may not quite be up there with Einstein’s theory of general relativity, compounding is a powerful concept in investing. It entails generating returns, not only on your initial investment but also on the accumulated returns from previous periods.

The power of compound returns could help your wealth to grow, bringing you closer to achieving your financial and life objectives. And, if you take a long-term approach, you could reach the “compound investment tipping point” – the point at which your returns exceed your total investment.

Read on to find out how compound returns work and how they could help you reach the compound investment tipping point.

Compounding returns build over time

If your investments are performing well and yielding strong returns, you might consider exiting the market and liquidating your gains to fund your lifestyle or achieve your shorter-term goals.

While this approach may align with your current objectives, reinvesting your returns could offer the added advantage of compounding, potentially enhancing your long-term financial growth.

Let’s say you invested £10,000 that yielded 5% returns on average each year.

After one year, your investment would have grown to £10,500. The following year you would generate a further 5% on both your initial £10,000 investment and the £500. So, you would have £11,025.

These effects build exponentially, and compounding can significantly boost the value of your investments over time.

Compounding returns could help you reach the compound investment tipping point

Compound returns often create a snowballing effect, which can lead to a point when your returns surpass your initial investment.

If you continue reinvesting, you may eventually reach the compound investment tipping point.

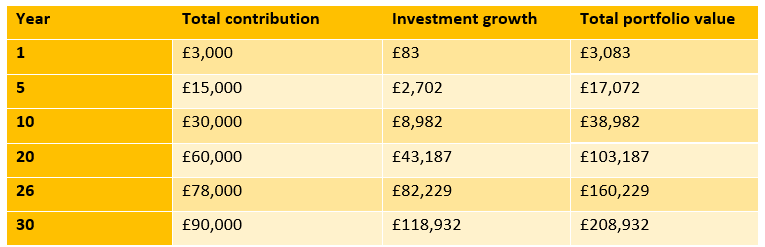

The table below shows the effect of compounding returns on a regular £250 monthly contribution with 5% growth over a 30-year horizon.

Source: This is Money

By the 26th year, your contributions would total £78,000, and your investment growth would have reached £82,229. This means your returns would now equal 105% of the value of your contributions. You would have reached the compound investment tipping point as the value of your returns is greater than your total investment.

This demonstrates how compound returns could help you achieve significant growth over long horizons.

The time horizons required to reach the compound investment tipping point underscore the importance of a long-term approach. Given the extended duration necessary to achieve it, aiming for the tipping point is most practical when saving for long-term goals such as building your retirement fund.

5 ways to help you reach the compound investment tipping point

Nothing can guarantee returns on your investment or ensure you reach the compound investment tipping point, but there are several ways you can improve your chances.

1. Understand your risk profile

Risk is inherent in investing, and balancing your risk exposure is crucial to achieving long-term financial success.

When focusing on investing for your long-term goals, you could increase your risk exposure compared to your short-term objectives, particularly during the early stages of your investment journey. This is because you have more time to recover any short-term losses you might endure.

Your risk profile isn’t fixed and will change over time, so a regular review is advisable. So, it is a good idea to speak to a financial planner to understand your risk exposure and how it relates to your goals and time horizons.

2. Diversify your portfolio

Diversifying your portfolio across a range of sectors, regions, and asset classes helps to reduce the risk of any one stock hurting your overall performance. It also widens your opportunities for capturing returns.

So, when looking at your long-term goals, portfolio diversification is often a key part of reducing risk, capturing returns, and facilitating steady, stable progress.

3. Review your investment costs and fees

The costs and fees associated with investing can add up significantly, especially if you frequently buy and sell investments.

The simplest way to mitigate these expenses is to leave your investments alone for as long as possible. While occasional adjustments may be necessary, allowing your investments to grow undisturbed can help maximise returns and minimise fees over the long term.

4. Set clear goals and stick to your plan

Defining your financial goals and setting a time horizon before you make investment decisions ensures that your strategy aligns with your life and financial objectives.

Being clear on what you are trying to achieve could also help you stay focused and disciplined, and to avoid making impulsive decisions amid short-term market volatility.

5. Speak to a financial planner

A financial planner can help you with each of the above steps, necessary for reaching the compound investment tipping point.

They can work with you to create a financial plan aligned with your long-term objectives, which over time, could see your investments start to generate substantial returns independently, significantly enhancing your wealth.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.