The old investing saying, “time in the market beats timing the market”, highlights the value of staying invested over the long term rather than trying to predict opportune moments to buy or sell.

While attempting to time the market might seem like a way to avoid losses or capture quick gains, it often results in missed opportunities and greater risk. Market movements can be highly unpredictable in the short term, making it difficult to make the right call.

In contrast, history shows that markets generally trend upward over time, rewarding investors who stay the course with steady growth. By remaining invested, you give yourself the best chance of benefiting from market recoveries and long-term performance, which is something short-term timing strategies rarely deliver.

With the recent market turmoil in the wake of the US trade tariffs, you may be tempted to sell off and limit your losses, but history shows this is usually not the best method to recover.

Read on to find out the potential benefits of long-term investing and why time in the market beats timing the market.

The chances of achieving positive returns increase over time

Over the long term, markets trend toward growth. The longer you remain invested, the greater your chances of not only recovering from downturns but also achieving strong overall returns.

A study by Nutmeg, which analysed global stock market data from January 1971 to July 2022, revealed just how powerful time in the market can be. If you had invested for just one random day during that period, you would have had a 52.4% chance of making a gain. But extend that investment to a full quarter, and your odds of a positive return would rise to 65.6%.

Investing for a full year would have increased your chances of profit to 72.8%, and over 10 years, the likelihood of a positive return would have climbed to an impressive 94.2%.

The graph below shows the results of Nutmeg’s study and how maintaining your investments over longer time horizons can significantly improve your chances of success in global markets.

Source: Nutmeg

As the data shows, once you’ve held your investments for 12 years, the probability of achieving positive returns is close to 100%.

This underscores the power of a long-term investment strategy. By staying invested, you allow your portfolio to benefit from the market’s historical upward trend, giving it time to recover from short-term losses and realise long-term growth.

Even when markets fluctuate or dip, maintaining patience, discipline, and resilience can pay off, as the long-term outlook remains positive.

Of course, it’s important to remember that the value of your investments (and any income from them) can go down as well as up, and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Historically, exiting during downturns has been less effective for recovery than staying invested

During periods of market volatility or downturns, it’s natural to feel concerned when you see the value of your portfolio decline. This may tempt you to exit the market in an attempt to avoid further losses.

However, a decline in value is only a paper loss unless you choose to sell. By staying invested, you give your portfolio the opportunity to recover – something markets have consistently done over the long term.

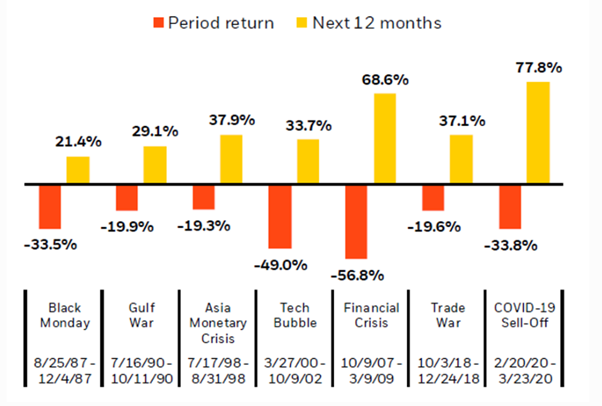

The chart below illustrates this pattern, showing how the S&P 500 experienced negative returns during major global crises since 1987, followed by strong rebounds within the subsequent 12 months. This highlights the importance of remaining invested and focusing on long-term growth rather than reacting to short-term dips.

Source: Forbes

If, for example, you had exited the market during the pandemic in 2020, as returns fell by more than 30%, you would have missed the chance to recover your losses and benefit from 77.8% growth the following year.

So, while market downturns often accompany major global events, history demonstrates that these declines are usually temporary and are often followed by a considerable rebound as investor confidence is restored.

The market also has a better chance of beating inflation over time

In addition to increasing your chances of positive returns, the market also has a better chance than cash of outpacing inflation over long time horizons.

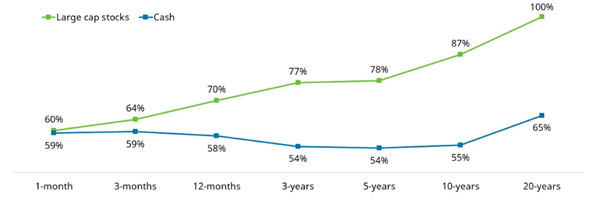

The graph below shows the percentage of time where US stocks and cash have beaten inflation between 1926 and 2023.

Source: Schroders

As you can see, if you invested for a month over that almost 100-year period, you would have lost money 40% of the time in inflation-adjusted terms.

However, over a five-year horizon, that figure falls to 22%, and at 10 years, it is 13%. Indeed, the analysis reveals that there were no 20-year periods between 1926 and 2023 when US stocks lost money in inflation-adjusted terms.

Conversely, any money you held in cash would have always had between a 35% and 45% chance of losing value, no matter how long you held it for.

Get in touch

Amid market downturns, it can be difficult to maintain discipline and resilience, but the evidence shows the benefits of doing so.

A financial planner can help you to create a plan that focuses on long-term, steady growth rather than short-term reactions.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Approved by Best Practice IFA Group 10/04/2025