After decades of building your savings, retirement should be the time to enjoy your hard work, but many retirees find their money doesn’t stretch as far as they expected.

The problem often isn’t a lack of savings, but inefficient withdrawals and unnecessary tax losses.

Having a clear plan for how and when to draw income can make a significant difference. With the right strategy in place, you can cover day-to-day expenses, fund your big goals, and ensure your wealth remains tax-efficient over the long term.

Read on to find out how planning your retirement income can help your savings go further and give you financial peace of mind throughout retirement.

Defining what you want from retirement can help you build a plan to support it

Before you can create a retirement income plan, it’s important to picture what you actually want your life after work to look like. The clearer your vision, the easier it is to build a financial plan that supports it.

You may want to consider:

- When you want to retire

- Where you’d like to live

- Your expected regular expenses based on your ideal lifestyle

- The big trips you want to take

- The financial support you plan to provide to family

- Any significant debts you have left to pay

- The legacy you hope to leave.

Once you’ve clarified your goals, you can factor in elements outside your control, such as inflation, future care costs, or shifts in market performance.

A financial planner can use cashflow modelling to help you project different scenarios based on your goals and external variables. They can show you how your spending, income, and savings might change over time. This can give you an idea of how you may need to manage your finances and help you make decisions that keep you on track.

Reviewing your pensions can help keep withdrawals efficient

For most people, their pensions are the foundation of their retirement income. So, when creating a retirement income plan, it’s important to understand what you have and how to draw from it efficiently.

Start by checking your State Pension forecast to see what you’ll receive and when your payments will begin. If you’re not set up to receive the full amount, you might want to consider topping up your National Insurance contributions.

Then, check in with your workplace and personal pensions.

You can usually withdraw 25% of your pension tax-free, up to the Lump Sum Allowance of £268,275 (2025/26), either all at once or in stages through drawdown.

Knowing how much you have saved and the value of your lump sum is key to creating an efficient withdrawal plan, as it allows you to balance tax-free pension withdrawals with other allowances.

Blending your pension with other income sources can make your income go further

Combining your pension withdrawals with other tax-efficient assets, such as ISAs, can make a big difference to how far your retirement income goes.

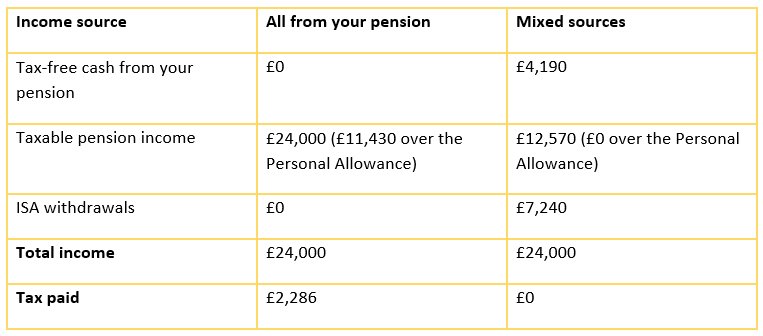

For example, let’s imagine a scenario where you’ve already withdrawn the tax-free portion of your pension in a lump sum and you want £2,000 a month to live on. If you drew it all from your pension, you could end up paying around £2,286 a year in Income Tax.

However, if you combined different income sources and accessed the tax-free portion of your pension gradually through drawdown, you could have the same amount of income without paying any tax.

You can achieve this by drawing from ISAs, using your tax-free pension allowance, and making full use of your £12,570 Personal Allowance (2025/26).

One possible approach could look like this over a year:

So, by utilising your allowances and creating a structured withdrawal plan, you can minimise tax and allow your savings to stretch further.

It’s important to regularly review your plan

Major life events, unexpected costs, market fluctuations, and inflation can all affect your financial standing in retirement.

By reviewing your plan once a year, you can adapt your withdrawals to ensure you remain tax-efficient and stay on track towards your long-term goals.

A financial planner can help you throughout the process of creating a retirement income plan. From setting clear financial goals to reviewing your pensions and savings, they can work with you to create an efficient strategy that ensures you enjoy the retirement you deserve.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Risk warnings

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article does not constitute tax, legal or financial advice and should not be relied upon as such. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. For guidance, seek professional advice.

Approved by Best Practice IFA Group Limited on: 13/11/2025