In August, global markets experienced some of the sharpest volatility in recent years, as analysts widely predicted a US recession based on the latest unemployment figures.

However, after the news triggered significant downturns in most major markets, many posted gains the following day, with some even breaking new single-day records. By the close of the month, most indices had recovered, and a US recession no longer seemed likely.

The volatility of those tumultuous 48 hours may have spooked you into action. However, market fluctuations often tempt investors into costly errors, and a long-term, disciplined approach is usually a better strategy for sustained success.

While the summer fluctuations may be behind us, there is always the potential for more downturns and spikes on the horizon.

So, with that in mind, here are four common mistakes to avoid amid market volatility.

1. Attempting to time your exit or entry

The old investing adage goes: “Time in the market beats timing the market.”

While this may sound like a cliché if you’re a seasoned investor, its wisdom holds true, especially during periods of volatility.

Whether you’re looking to capitalise on the latest trend or cut your losses amid a downturn, attempting to time the market can lead to missed opportunities and greater risk.

For example, research by Schroders revealed that exiting the market during historical downturns would have likely cost you in the long run.

The study revealed that investors who liquidated their holdings and moved to cash after the first 25% fall of the Great Depression in 1929 would have faced a long road to recovery. They would likely have had to wait until 1963 to break even from cash returns. In contrast, those who stayed invested would have recouped their losses by 1945 – a full 18 years earlier.

Similarly, investors who shifted to cash after the first 25% of losses in the 2008 financial crisis would still not have broken even today. Those who remained invested would have seen the value of their investments recover by around 2013.

Moreover, attempting to time your entry into the market to capture returns on the latest top performer is also unlikely to lead to success.

Further research by Schroders found that in 12 of the last 18 years, none of the top 10 performing US stocks one year ranked in the top 10 the following year. In five of the remaining six years, only one stock achieved this. In the other year, just three managed to do so.

So, whether you’re hoping to capitalise on high-performing stocks or cut your losses during a downturn, focusing on long-term steady growth and maintaining your investments has typically been a better strategy for success than attempting to optimally time your entry or exit.

It’s also important to remember that past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up and you may not get back the full amount you invested.

2. Focusing on short-term noise rather than long-term goals

In finance, “noise” refers to short-term market fluctuations or random movements that don’t reflect the underlying fundamentals or long-term trends.

While it may be tempting to follow generalised, “expert” advice on these short-term changes, history and research suggest that such advice is not always reliable.

A study reported by Vox examined the predictive accuracy of 284 economic and political experts over two decades. It found that if these experts had made predictions randomly, their success rate would likely have been higher.

Interestingly, the study also revealed that experts who frequently appeared in the media performed worse than their lower-profile peers. This is perhaps due to the pressure on them to provide confident predictions in response to the market’s noise and media demands.

So, ignoring advice based on short-term noise rather than your personal long-term goals can help you avoid unnecessary reactions to market fluctuations and keep your plan on track.

3. Keeping a concentrated portfolio

Portfolio concentration refers to the degree to which an investment portfolio is focused on a small number of assets, sectors, or regions. While this may occasionally result in high returns, it also leaves you vulnerable to losses.

Conversely, portfolio diversification is a strategy for managing risk, minimising losses, and increasing your chances of achieving returns.

By distributing your investments across various asset classes, sectors, and regions, you lower your exposure to the fluctuations of any single market. Additionally, this approach allows you to tap into multiple markets, enhancing your ability to benefit from diverse opportunities.

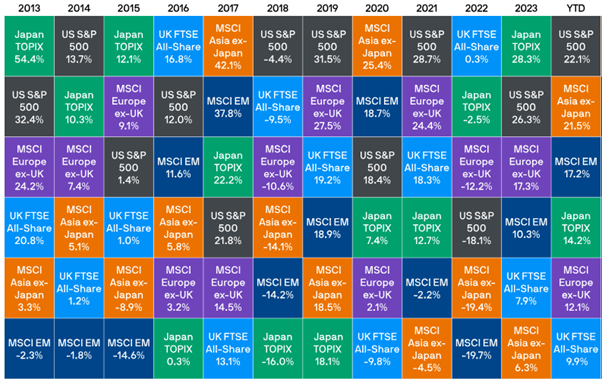

For example, the table below shows the annual performance of a range of global indices for the last decade.

Source: JP Morgan

As you can see, predicting which markets will perform well or poorly from year to year is nearly impossible.

For example, the UK FTSE All-Share was either the best or second-best performer for three years, but was the worst or second-worst for five.

So, by diversifying your portfolio and steering clear of concentration, you can create more stable investments that help protect your holdings from significant declines, and capitalise on a wider range of opportunities, ultimately enhancing your resilience to market volatility.

4. Listening to your biases rather than personalised, professional advice

Investor biases are cognitive or emotional tendencies that can affect your decision-making and lead to poor financial choices.

Investor biases include overconfidence, loss aversion, and herd mentality, among others.

For example, overconfidence may cause you to underestimate risks and overestimate your ability to predict market movements, while herd mentality may push you to follow the latest trend only for the bubble to burst shortly after.

While you may be susceptible to such biases, a professional financial planner can provide a more experienced and objective perspective to help you navigate financial decision-making.

They can assist you in creating a well-structured financial plan that takes into account your personal risk tolerance and long-term goals.

With such expertise, you can mitigate the effects of emotional or investor biases, make informed choices, and improve your stability amid market volatility and downturns.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Risk warnings

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.