The new year is a time to pause and reflect on your goals for the future and consider how to set yourself up to achieve them.

While you may already have resolutions focusing on health, habits, or making more time for your family, it’s also a good moment to take stock of your finances.

Reviewing your position at the start of the year can help you move closer to your goals, spot opportunities you may have missed, and make more informed decisions for the months ahead.

Read on to discover five financial resolutions that can help you thrive in 2026.

1. Increase your pension contributions

Making additional pension contributions can significantly boost your retirement income, and even relatively small increases can go a long way over time.

While you may already contribute a fixed amount from your earnings each month, at the start of the year, it’s worth reviewing whether you could afford to increase those contributions.

Each tax year, you can contribute up to the Annual Allowance. In 2025/26, for most people this is set at £60,000 or 100% of your earnings, whichever is lower. You can also carry forward any unused Annual Allowance from the previous three tax years, which can be particularly useful if you want to make a larger contribution.

The real power of pension saving comes from compounding, and a small increase can add up over time as investment growth builds on itself.

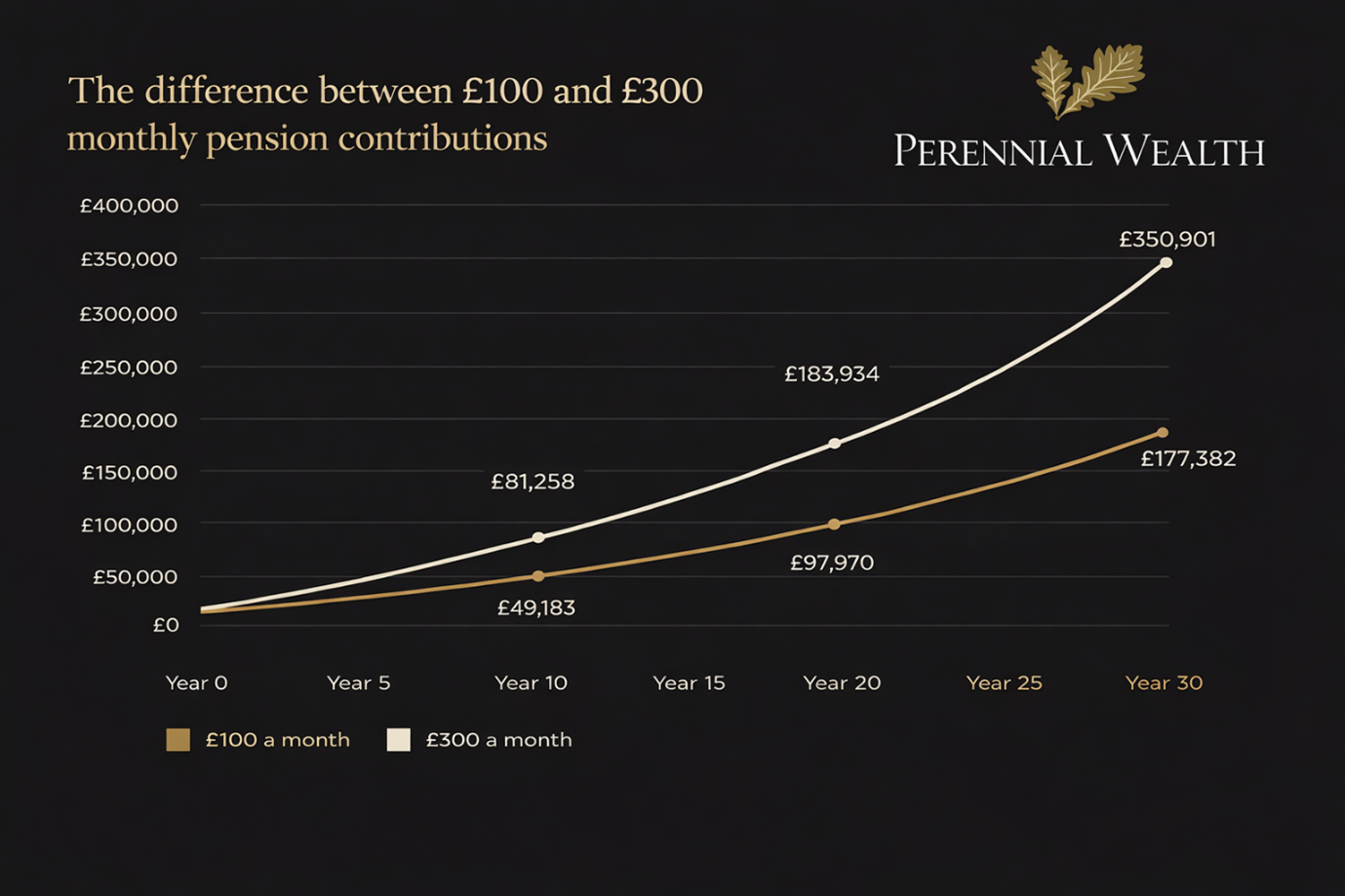

For example, the graph below shows two £20,000 pension pots growing at 5% a year over 30 years. One receives £100 a month, while the other receives £300.

As you can see, contributing an extra £200 a month could result in over £30,000 more after 10 years, nearly £90,000 more after 20 years, and more than £170,000 extra after 30 years.

Increasing your pension contributions, even modestly, could be one of the best financial decisions you make this year, and could significantly improve your financial security in retirement.

A financial planner can help you adjust your pension contributions to make sure you have enough income for now and the future.

2. Give your wealth the best chance to grow

2025 wrapped up a strong year for markets.

While markets won’t always deliver such strong returns, investing typically gives your wealth the best chance of beating inflation over time compared to other options. Most savings accounts, for example, only offered interest rates of around 2% – 4% over the same period.

Indeed, research reported by MoneyAge found that if you had chosen to save your money in Cash ISAs instead of investing between 1999 and 2025, you could have missed out on around £134,000 in inflation-adjusted growth.

That said, cash savings still play an important role, and are good for short-term goals, planned spending, and emergency funds. However, when it comes to your long-term objectives, investing is typically the more effective way to grow wealth.

A financial planner can help you balance your savings and investments, ensuring you have enough secure cash while giving your wealth the best possible chance to grow.

3. Use your allowances before they reset

The new year is the perfect time to check that you’re making full use of your available tax-efficient allowances before they reset at the start of the new tax year in April.

This might include:

- Maximising your £20,000 ISA allowance

- Reviewing your pension contributions and carrying forward unused allowances from previous years if necessary

- Using your Capital Gains Tax (CGT) annual exempt amount, if you plan on selling significant assets.

Planning early in the year can help you make full use of your allowances, reduce your tax bill, and ensure your money is structured as efficiently as possible for the year ahead.

4. Create a budget for 2026

The start of a new year is a good moment to review your budget and consider how it may be affected by changes in your personal circumstances, as well as the wider economic environment.

For example, inflation can increase everyday costs such as food and energy, while changes in interest rates may affect your mortgage or loan repayments. Personal milestones, such as starting a new job or welcoming a child, can also have a significant impact on your income and spending.

Taking time at the beginning of the year to review these factors and adjust your budget accordingly can help ensure your finances remain aligned with your current needs and long-term goals.

A well-structured budget allows you to track where your money is going, reduce unnecessary spending, manage debt more effectively, and set aside funds for saving and investing.

You can read more about how to create a budget in our previous article on the topic.

5. Review your progress towards your goals

At the start of the new year, you may want to review your progress towards your financial goals and make any adjustments needed to keep you on track or reflect changes in your circumstances.

You can also use this opportunity to set new goals or adjust your time horizons based on changes in your income, spending, or life events. Even small adjustments can help ensure your plan remains realistic and aligned with what matters most to you.

Get in touch

A financial planner can work with you to create targets and resolutions for the new year to help ensure you move closer to your goals in 2026.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Please note

This article is for general information only and does not constitute advice. The information is aimed at individuals only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article does not constitute tax, legal or financial advice and should not be relied upon as such. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. For guidance, seek professional advice.

Any links will direct to a third-party website and Perennial Wealth is not responsible for the accuracy of the information or content contained within third-party sites.