Over the last few years, inflation has never been too far from the headlines.

After peaking at 11.1% in 2022 – the highest level in over 40 years – the Bank of England (BoE) steadily raised the base rate to curb rising prices.

The BoE incrementally increased the base rate 14 times, from 0.1% in December 2021 up to 5.25% by August 2023. It held the rate at 5.25% for a full year before beginning to reduce it again in the summer of 2024.

According to the Office for National Statistics (ONS), these measures initially proved effective. Inflation reached the BoE’s target rate of 2% in May and June 2024 and dropped further to 1.7% in September.

However, inflation stayed above the target rate for 9 out of 12 months last year and has risen since September, reaching 2.5% in December.

This kind of persistent inflation, even at modest levels, is referred to as “sticky inflation.” Sticky inflation occurs when prices don’t change in response to a shift in demand, leading to long-term inflation above optimal levels.

Read on to find out three ways sticky inflation could affect your finances and what you can do about it.

1. Your daily expenses could increase

Inflation refers to the general increase in prices. So, even when inflation is at manageable levels, it’s important to remember that “lower” inflation rates don’t indicate falling prices, only that prices are increasing at a slower rate.

For example, the prices that soared by more than 11% in 2022 haven’t returned to their previous levels and are still continuing to rise, albeit more slowly.

Persistently high inflation can significantly drive up your regular expenses, which may reduce your purchasing power if your income fails to keep pace.

So, as prices continue to climb, adapting your budget based on your expenses and financial goals could help keep your outgoings under control. By conducting a review of your expenditure in relation to your income, you can work to ensure your progress towards your long-term goals is not hampered by the effects of sticky inflation.

You can read more about how to design and manage a budget that works for you in our previous article on the topic.

2. Your cash savings could lose their real-terms value

Cash savings are particularly vulnerable to inflation, as the returns offered by many savings accounts often fall below the inflation rate, which can diminish your purchasing power over time.

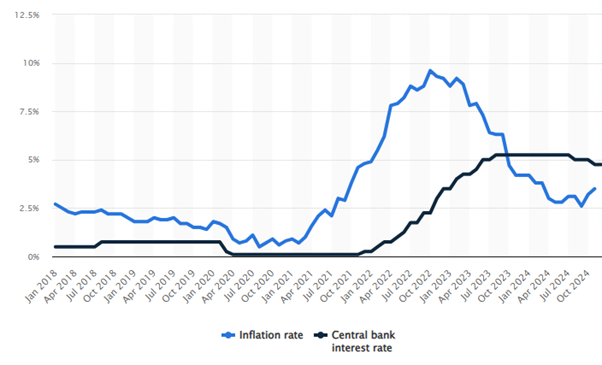

For instance, the graph below shows the average consumer price inflation (CPI) rate alongside the BoE base rate between January 2018 and October 2024.

Source: Statista

As you can see, inflation was consistently the higher of the two until the end of 2023, when the BoE raised the base rate to 5.25% – its highest level since the global financial crisis. So, it’s likely that throughout most of this period, your cash savings would have struggled to keep up with inflation.

Research by Schroders reveals that over different time horizons, cash has approximately a 60% chance of outpacing inflation. The same analysis also found that over longer periods, the stock market has a significantly higher probability of outperforming inflation, achieving a 100% success rate over a 20-year horizon.

So, while the market may experience fluctuations, long-term investments have the potential to deliver returns that outpace average inflation.

While it’s a good idea to keep some savings in cash – such as in your emergency fund – investing a portion of your wealth could help preserve its purchasing power over the long term.

It’s important to remember that the value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

3. Interest rates could remain high, which may affect the costs of borrowing

Although the BoE began lowering the base rate in August, it decided to hold the rate at 4.75% in its December meeting in response to the renewed rise in inflation.

This decision could affect borrowing costs, especially if you have a tracker- or variable-rate mortgage or are nearing the end of a fixed-rate loan term.

For tracker- and variable-rate mortgages, the interest you pay is directly influenced by the base rate, meaning any increase in interest rates could result in higher monthly repayments.

Similarly, if your fixed-rate mortgage or loan term is ending, your lender will use the base rate to determine your new level of interest, which could mean your monthly repayments increase if the rate remains high.

While there is little you can do to change the repayment rates set by your lender, ensuring you have a diversified portfolio can help you mitigate excess costs in one area by balancing them with gains or stability in other areas.

By spreading your investments across various asset classes, you can create a financial cushion to offset higher repayment costs and help maintain long-term financial stability.

Get in touch

A financial planner can work with you to develop a tailored strategy that helps protect your finances against high or sticky inflation. We can help you create and manage a budget, explore investment opportunities, and diversify your portfolio to help ensure your long-term stability.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Approved by Best Practice IFA Group 28/01/2025.