If you’re a senior executive, you likely have multiple financial considerations that most people don’t have to contend with, and with those considerations come unique opportunities and risks.

From choosing share incentive schemes and managing your investment concentration to drawing your income tax-efficiently and making the most of pension contributions, there are many moving parts to handle.

Balancing these decisions alongside the demands of running a business can be challenging, but that’s where a financial planner can help. They can work with you to optimise your finances, reduce risk, and align your business and wealth to serve your long-term goals.

Read on to discover three ways financial planning can help senior executives.

1. Help you explore and understand share schemes and incentives

As an executive, you may receive a significant part of your pay in the form of company shares. While these schemes are intended to align your interests with those of the business and its shareholders, they also introduce complexity that requires careful planning.

It’s also important to consider how these arrangements affect not only your position but also the wider shareholder base and employee structure.

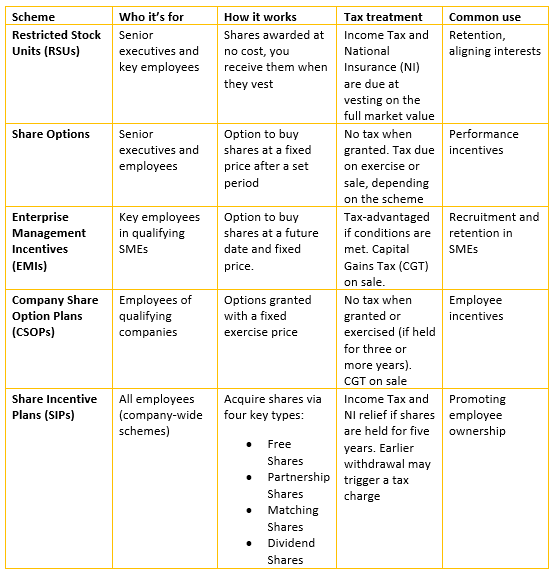

You can see an outline of some of the main share scheme options in the table below.

These schemes are all employer-sponsored and offered to employees. However, some, such as RSUs and share options, are more commonly used for senior executives, while others, like SIPs, are used across the whole workforce.

A financial planner can help you explore and understand the different options available and which would be best suited to your company.

2. Avoid the risks of overconcentration

You may find that a significant portion of your wealth is tied up in your company’s stock. While this can be a sign of confidence in your business, it could also mean you are overconcentrated.

Relying too heavily on a single company for both your income and your investments means your financial stability is tied to one source. If the company underperforms or faces unexpected challenges, you could see both your salary and your investment value fall at the same time, which could significantly affect your long-term goals.

As such, it’s important to diversify. Diversification is the principle of spreading your wealth across different assets, sectors, or regions so that your financial security isn’t dependent on the fortunes of one business or market.

A financial planner can help you assess how much of your total wealth is tied to your business. They can then work with you to gradually reduce your exposure over time and create a more balanced portfolio structured around your risk tolerance.

3. Draw bonuses tax-efficiently

Without careful planning, your bonuses could push your income into higher tax bands. By structuring how you draw your bonuses alongside your income, you can ensure your earnings remain efficient.

For instance, once your income exceeds certain levels, several allowances begin to taper or are lost entirely, including:

- Personal Allowance – For every £2 of income over £100,000, you lose £1 of your tax-free Personal Allowance. This creates an effective 60% tax rate on income between £100,000 and £125,140, by which point you lose your Personal Allowance altogether.

- Free childcare eligibility – If you or your partner earn above £100,000, you lose your eligibility for 30 hours of free weekly childcare in England, which can be worth several thousand pounds a year.

- Child Benefit High Income Charge – If you or your partner earn over £50,000, the Child Benefit begins to taper, and is fully rescinded at £60,000.

These thresholds can significantly increase your tax liability and total household finances. Fortunately, there are ways to manage your taxable income to remain under key thresholds and retain access to these benefits.

For example, making additional pension contributions can reduce your adjusted net income and potentially bring it back below some of the thresholds. By redirecting part of a bonus into a pension, you can convert a highly taxed one-off payment into long-term savings that grow tax-efficiently.

You can read more about how pension contributions can help you avoid the 60% tax trap in our previous article on the topic.

A financial planner can help you explore ways to structure your bonuses efficiently, whether that’s through contributing to your pension, gifting to family members, or considering alternatives such as spousal pension contributions.

Get in touch

The role of a senior executive comes with many crucial financial decisions, but you don’t have to make them alone.

A financial planner can help you determine which payment, share, and diversification options are best for you and your business, giving you peace of mind in both your personal and professional life.

To speak to a financial planner, get in touch.

Email info@perennialwealth.co.uk or call 0117 959 6499.

Risk warnings

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.